Car insurance is essential because owning a vehicle brings many risks and accidents. If you have a sedan, an SUV, or a motorcycle, the right auto coverage gives you financial protection if you crash, someone steals your car, or you face other similar issues. Getting and comparing auto insurance quotes is a key step in buying a car insurance policy. This article explains car insurance quotes, including why they matter, what decides them, and how to get the best quote.

What is a Car Insurance Quote?

A car insurance quote is, therefore, a measure of the cost that an insurance company will be willing to charge to offer the required insurance service. It is the price you will likely make for any policy, depending on your past records, the nature of the car, coverage, and other features. The quote must contain the amount of the proposed monthly premium, annual deductible, and optional forms of insurance it will offer, such as liability, collision, or comprehensive.

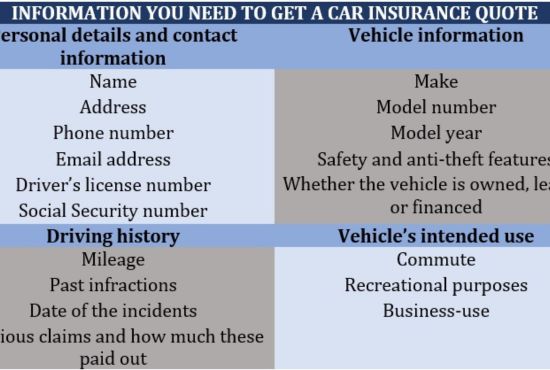

It is fairly easy to get car insurance quotes. With personal data and vehicle characteristics, the policyholder provides an outline of what kind of coverage he or she wants, and the insurance company provides a quote. This allows you to compare the various policies on offer, helping you make the right choice.

Why Are Car Insurance Quotes Important?

Car insurance quotes are essential for many reasons:

- Cost Comparison: You can compare rates from various insurance companies to find the lowest price.

- Custom Coverage: When you get multiple quotes, you can adjust your coverage to fit your needs, whether you want full coverage or a basic liability policy.

- Informed Decision: Quotes show you what different insurers offer, which helps you make a smart choice based on coverage, price, and customer service.

- Budgeting: Knowing how much insurance costs helps you plan your monthly or yearly expenses better.

If you don’t compare quotes, you might pay too much for a policy or not get enough coverage for your needs.

Factors Affecting Car Insurance Quotes

Many things have an impact on the car insurance quotes you get. Knowing these things can help you find ways to cut your premiums and get the most for your money. Here are some of the main things to consider:

Driving History

Your driving record has a big influence on your car insurance rates. Your driving record impacts your insurance costs. More accidents and traffic violations lead to higher premiums. Insurance providers see you as a bigger risk and charge more to insure you.

Age and Gender

Insurance companies often charge teens and new drivers more because they lack experience behind the wheel. Gender can also affect quotes. Statistics show that young male drivers are riskier to insure than females, so they often pay more.

Vehicle Type

The car you drive has an impact on your insurance quote. Pricey fast vehicles cost more to insure because they’re worth more and often need expensive repairs.

Location

Your location impacts your insurance rates. Urban areas with higher rates of accidents, theft, and property damage cost more than rural regions.

Credit Score

Insurance companies in many areas check your credit score to set prices. A good credit score can reduce expenses, while a poor score might increase pay.

Coverage Levels

The coverage you choose has a big effect on your quote. Choosing full coverage (liability, collision, and comprehensive) leads to a higher quote than just choosing liability coverage.

Deductible Amount

The deductible is the money you pay before the insurance company covers the rest. A higher deductible can cut your premium, but it also means you’ll pay more upfront if you make a claim.

Mileage

How many miles you drive each year can change your quote. If you’re on the road more, you’re more likely to have an accident, which might mean higher premiums.

Safety Features

Vehicles with cutting-edge safety technology, such as anti-lock brakes, airbags, and anti-theft devices, can result in cheaper insurance costs. Insurance companies give better rates to drivers who try to lower their chances of getting into accidents or having their cars stolen.

How to Get the Best Car Insurance Quotes

Now that you understand what has an impact on car insurance quotes, here are some tips to help you secure the best deal:

Compare Multiple Quotes

To get the cheapest car insurance quote, compare offers from several insurers. Each company uses a different formula to calculate rates, and by looking around, you can find the lowest price for your situation.

Use Discounts

Most insurance companies give many discounts that can lower your premium. Common discounts include safe driver discounts, multi-policy discounts (for bundling home and auto insurance), and good student discounts for young drivers.

Increase Your Deductible

A higher deductible can cut your premium. But make sure you pick a deductible you can afford if you need to file a claim.

Keep Your Credit Score High

Many insurers look at credit scores to set quotes, so a good credit score can help you get a lower premium. Pay bills when they’re due, cut down debt, and check your credit report often to keep your score strong.

Pick a Car That Costs Less to Insure

When buying a new car, consider how its type, model, and year will change your insurance premium. Safer cars cost less to repair, thieves steal less often and have lower insurance rates.

Drive Less

Let your insurance company know if you drive or have a short commute. Some insurance providers offer better rates to drivers who don’t use their cars much. This happens because they spend less time on roads, which reduces the risk of accidents.

Consider Usage-Based Insurance

Some insurance companies provide usage-based or pay-per-mile insurance plans, which suit people who don’t drive often. These plans monitor your driving habits, including your speed braking patterns and mileage, and adjust your rates based on this data.

Review Your Coverage

Reviewing your insurance coverage when your life situation changes (like moving or getting a new car) is a good idea. This helps ensure you’re not overpaying for coverage you no longer need or missing out on potential savings.

Look into Group Insurance Plans

Some companies, professional groups, or alumni associations have group car insurance plans that are cheaper than individual plans. Check if you’re eligible for any group insurance discounts.

Conclusion

To score the best car insurance quotes, consider your driving habits and vehicle type needs. By comparing quotes from various providers and taking advantage of discounts, you can find a policy that offers the right coverage at a fair price. Remember to review your policy , maintain a clean driving record, and keep a good credit score to continue getting favorable rates.

Remember, car insurance isn’t just a legal requirement; it’s a safety net that protects you and other drivers. Spending some time comparing different car insurance quotes and finding the best deal pays off because it can save you big bucks down the road.

Read more:

A complete guide on truck accident attorney dallas